What is CMA Course?

![]() By IIC Lakshya

By IIC Lakshya

![]() 02 Aug 2024

02 Aug 2024

![]() CMA INDIA, CMA USA

CMA INDIA, CMA USA

In the world of finance and accounting, like any other prestigious certification, such as ACCA, CA, CFA, or CPA, the CMA course also stands at par with these certifications due to its global acceptance across 150 countries and acknowledgment. So what is the CMA course?

What is the Full-Form of CMA?

CMA course full-form is Certified Management Accountant, it is a professional credential that primarily focuses on equipping individuals with efficient financial management skills, strategic decision-making knowledge, and financial planning within organizations.

Additionally, the CMA is also known as the US CMA, because the body that grants this qualification, the Institute of Management Accountants (IMA), is based in the US. Through this comprehensive guide, we'll explore the essence of the CMA qualification by going over its eligibility criteria, CMA course duration, CMA course details, career prospects with CMA, and much more, keeping in view that you get to plan your CMA journey effectively.

CMA USA is one of the most prestigious global certifications in management accounting, opening doors to high-paying careers in finance, business strategy, and leadership. With just two exam levels, it equips you with advanced skills in financial planning, analysis, and decision-making. Want to know how to become a CMA USA and boost your career? Watch our YouTube video now!

CMA India is a highly recognized professional course that builds expertise in cost management, accounting, and strategic decision-making.It opens career opportunities in auditing, taxation, finance, and top-level corporate roles across industries. Curious about CMA India and how it shapes your career? Watch our YouTube video to learn more!

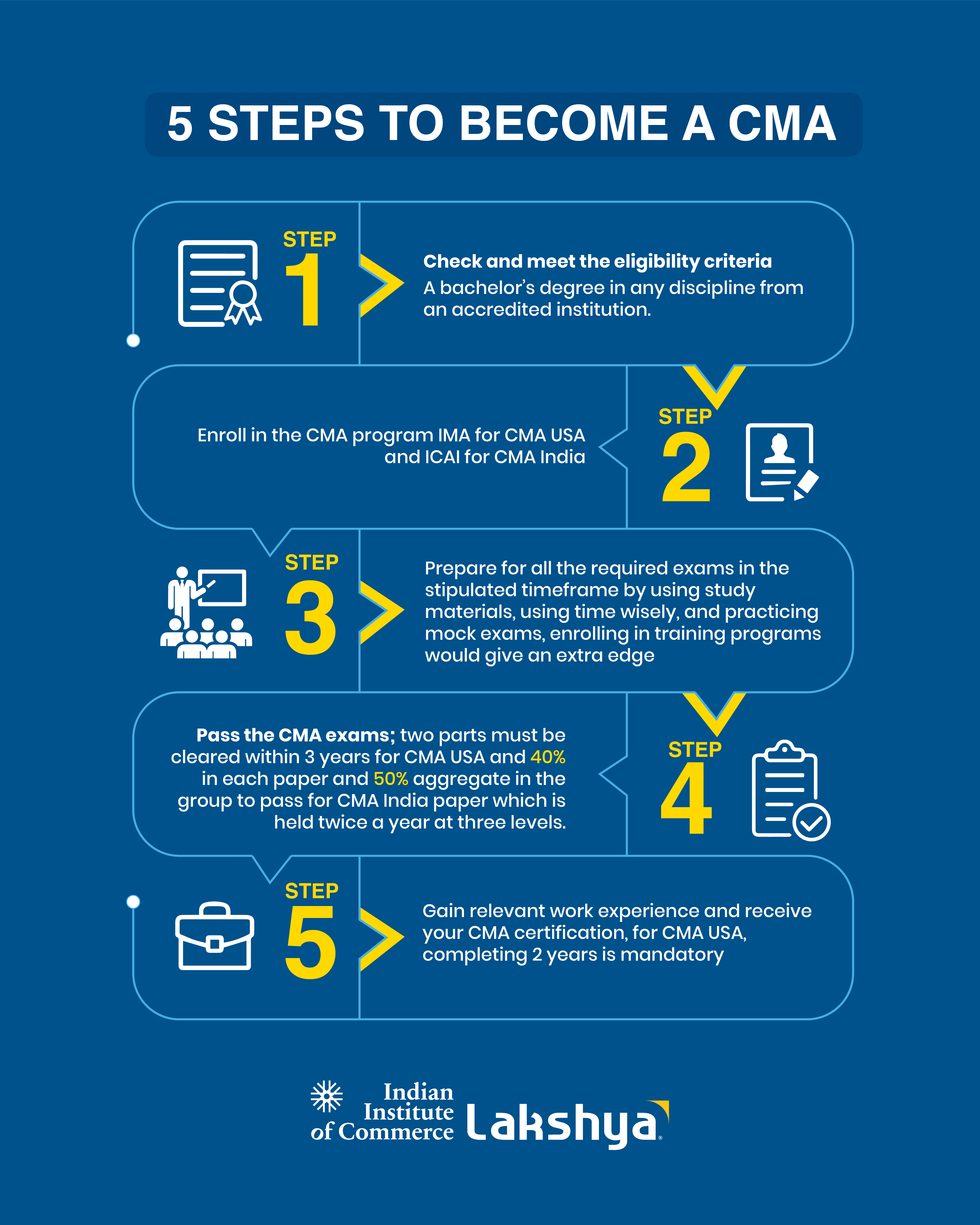

5 Steps to Become a CMA

Step 1: Meet the Eligibility Criteria

Before starting the CMA journey, you need a bachelor’s degree in commerce, finance, accounting, or a similar subject from an accredited college. If you’re still in college, you can sign up, but you must graduate before getting the CMA certificate. A solid grasp of accounting and management principles is also important.

Step 2: Enroll with IMA (Institute of Management Accountants)

Next, sign up to be a CMA candidate with the Institute of Management Accountants (IMA). You must pay for membership, an application fee, and the exam costs. Completing this step gives you the official green light to move forward with the CMA process.

Step 3: Prepare and Pass the CMA Exams

The CMA exam is made up of two parts:

- Part 1: Financial Planning, Performance, and Analytics

- Part 2: Strategic Financial Management

Both sections measure analytical skills, accounting knowledge, and decision-making ability. A solid study plan, possibly some coaching, and lots of practice tests will help you pass both parts on the first try.

Step 4: Gain Relevant Work Experience

To actually earn the CMA credential, you must have at least two years in a job involving management accounting, financial analysis, budgeting, or auditing. You can get this experience before or within seven years after you pass the exam.

Step 5: Get Certified and Keep Your CMA Badge Shiny

After you nail the two CMA exam sections and clock the required work hours, you officially earn the CMA title. But the journey doesn’t end there—keeping your credential means you must finish 30 hours of Continuing Professional Education, or CPE, each year. These CPE hours help you keep pace with new industry standards and sharpen your skills, so you stay ahead of the game and keep that shiny CMA badge for life.

What is CMA Eligibility Criteria?

Now that you are aware of what the course is, to officially be able to pursue this certification, you must be familiar with the CMA eligiblity to meet the following requirements :

1. You must have a bachelor's degree from an accredited college or meet the IMA’s specific educational requirement.

2. You must have work experience of a minimum of 2 years in management accounting or financial management. This requirement can be fulfilled before you have enrolled for your CMA examination or within 7 years of passing the examination.

CMA Course Duration

On average the CMA course duration is completed in 2 or more years. However, it depends on several factors these are as follows:

-

Education and Work Experience

If you already hold a bachelor's degree and have prior work experience of 2 years then you just need to qualify the part 1 and part 2 of examinations. However, if you don't hold a bachelor's degree or don’t have any work experience, then it must take longer.

-

Preparation time

The time you choose to dedicate to each part of the examination also impacts the overall CMA course Duration.

-

Learning Pace

Each individual has their own learning pace that can accordingly expedite or delay the CMA course duration.

-

Exam Attempts

The amount of attempts it takes to clear each part 1 and part 2 of the examination contributes to influencing the CMA course duration as well. Some students may pass both CMA exam parts on the first attempt, while others might need to retake, thus increasing the duration.

CMA Course Details

As we have discussed the CMA course, its eligibility criteria, and how long it takes to become a CMA, now let's break down the CMA course details, which include the examination syllabus, the format that the CMA course follows, and the number of times the CMA examination is held in a year.

Parts of CMA Examination

The CMA curriculum consists of 2 parts that you need to qualify to obtain your CMA certification.

Part 1:

Aims to provide a thorough understanding of Financial Planning, Performance, and Control. The key modules included in this part are:

- External Financial Reporting Decisions

- Planning, Budgeting, and Forecasting

- Performance Management

- Internal Controls

- Technology and Analytics

Part 2:

Aims to develop Financial Decision Making capabilities. The key modules included in this part are:

- Financial Statement Analysis

- Corporate Finance

- Decision Analysis

- Risk Management

- Investment Decisions

- Professional Ethics

What is the Frequency of CMA Exam?

The examination for both Part 1 and Part 2 is held in the following testing window each year:

- January/February,

- May/June,

- September/October

What is CMA Exam Pattern?

To get familiarised with the examination pattern, the structure is as follows:

|

Exam Part |

Duration |

No. Of Questions |

|

Part 1 |

4 hours |

100 MCQs & 2 essays |

|

Part 2 |

4 hours |

100 MCQS & 2 essays |

Career Paths with a CMA Certification

While exploring the CMA course details, you get the idea of the specifics, but with a CMA certification, what kind of career opportunities can you expect?

Well, the possibilities are endless.

The CMA certification unlocks the following enriching roles for you:

- Financial Analyst,

- Controller,

- Accounting Manager,

- Consultant,

- Corporate Finance Professional,

- Financial Manager,

- Cost Accountant.

Commerce coaching provides structured guidance for students pursuing courses like CA, CMA, ACCA, or B.Com by strengthening core subjects such as accounting, finance, economics, and business law. With expert faculty, doubt-clearing sessions, and regular assessments, it helps students build strong conceptual clarity. Good coaching also offers career counseling, updated study materials, and exam strategies, ensuring higher success rates in competitive exams and professional courses.

- IIC Lakshya Bengaluru

- IIC Lakshya Kochi

- IIC Lakshya Coimbatore

- IIC Lakshya Thrissur

- IIC Lakshya Dubai

- IIC Lakshya Trivandrum

- IIC Lakshya Kottayam

CMA India vs CMA US

The CMA India vs CMA USA are based on the same principles, share a similar prestige, and showcase a commitment towards professional excellence, ethical standards, and continuous learning in the field of accounting and management.

But what sets them apart?

Check Out This Informative video Explaining the Differences between CMA USA and CMA India:

The following table will help you consolidate your comprehension:

Feature |

CMA India |

CMA USA |

|

Governing body |

Institute of Cost Accountants of India(ICAI) |

Institute of Management Accountants(IMA) |

|

Exam Curriculum |

Three Levels: Foundation, Intermediate, & Final |

Two Parts: Part 1(Financial Planning, Performance & Control), Part 2( Financial Decision Making) |

|

Eligibility Criteria |

Bachelor’s degree from a recognised institution or should meet ICAI’s specific criteria |

Bachelor’s degree from an accredited institution or should meet IMA’s specific criteria |

|

Work Experience |

Not mandatory but advantageous |

2 years of work experience is required |

|

Exam Frequency |

Twice a year: June and December |

Thrice a year:January/February, May/June, September/October |

Read More

- CMA USA salary in India

- Career after CMA USA

- What is the salary for ACCA?

- How to Become an Auditor?

- Best Finance Courses in India

FAQs

What does a CMA do?

A certified Management Accountant(CMA) is a professional in the field of accounting management and financial decision-making that overlooks tasks such as budgeting, risk assessment, and cost management and provides strategic financial insights within organisations.

Is CMA better than CA?

Certified Management Accountant (CMA) and Chartered Accountant (CA) are both highly regarded certifications in the world of finance. They have their own strengths and specific areas they specialise in. CMA primarily focuses on areas such as management accounting, financial planning, and strategic decision-making within business. Meanwhile, CA covers broader domains, including auditing, taxation, financial reporting, etc. The choice between the two certifications, therefore, shall be guided by one’s career goals and interests.

Can I pass CMA with a job?

Yes, it is possible to pursue a CMA qualification while working a full-time job. However, it requires proper time management, planning and dedication. With consistency and discipline, working professionals can complete their CMA credentials while adhering to their professional commitments.

Can we do CMA without BCom?

The eligibility criteria for CMA do not specifically require a B. Com degree. A bachelor's degree from any discipline meets the eligibility requirement, as long as it is acquired from an accredited college or university. However, a B. Com degree is not mandatory, but it is beneficial.

.webp)

salary.jpg)

.webp)

.webp)

.webp)